Building off from where we left last week's entry, this week I will focus on three top-performing stocks on the TSX for 2012. In order to then assess whether the company is currently mired in an Innovator's Paradox (see my previous post to refresh on what this was) I will tabulate the companies against the following criteria suggested by Innosight: the company's need for growth; the resources that are available for new growth for the company; the company's perception about new growth; and the tendencies of the company's innovation efforts.

Next week I will look at 3 top-performing stocks on the NYSE/DOW for 2012.

This exercise is part of a 28-day innovation regimen that Scott Anthony outlines in his book, The Little Black Book of Innovation.

Next week I will look at 3 top-performing stocks on the NYSE/DOW for 2012.

This exercise is part of a 28-day innovation regimen that Scott Anthony outlines in his book, The Little Black Book of Innovation.

TickerYTD (2012)Need for growthResources for new growthPerceptions about new growthInnovation efforts tend to ... | WestJetWJA-T 71.9%Mid-HighMid-High"... we’re doing lots of exciting things at a time when the company’s right in the middle of a great growth plan." (Read more)... focus on hitting the inflection point. WestJet continuously seeks innovative ideas from its employees for cost cutting and efficiency with reported savings of into the millions. | Nexen Inc.NXY-T 62.6%LowHighNeeded. Shareholders have been promised results for the past few years and they will continue to expect it, likely more fervently than ever. ... disciplined. Nexen claims to derive a lot of value from employing state-of-the-art techniques to tap into tough-to-reach natural resources in as clean a way as possible. | Gildan Inc.GILT-T 82.8%Mid-HighHighGildan has manufacturing plants in the Carribean and South America, and is currently building in Bangladesh to support growing sales in North American and European retailers. ... be undisciplined and lack focus. They attain low costs by using cheap labour and often-times, according to news sources, to the detriment of working conditions. |

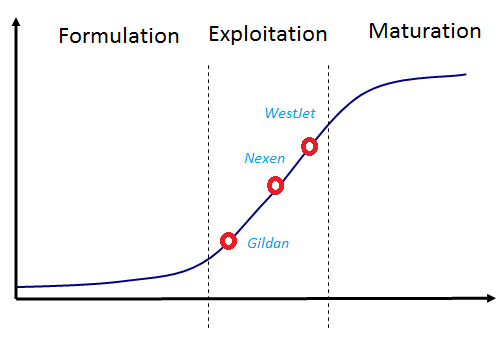

So, to plot them on the need-for-growth s-curve, I would reckon they might be placed something like this:

Note that this represents only my personal view of the three firms and their standing as of the end of 2012. Companies strategies, priorities and industrial landscape can change rapidly, so it is important to keep everything within context. WestJet might very well radically innovate anything in its value chain, thus, significantly altering its position on the graph above. Likewise for the other companies. The onus is on them to make sure they are not trapped in the Innovator's paradox, only to find that they should have innovated long before finding out that they are at maturation or, worse, starting to dip downward.

Corollary: Initially, I had mentioned that I would update this for multiple companies over successive weeks. Obviously, this has not happened. The new year has proven to be far more a time consumer than I had anticipated! Thus, for better or for worse, I have chosen to conclude this exercise here. I feel there are many, many other topics that are worth perusing through, too. Lets not forget the rest of the trees in this forest!

Corollary: Initially, I had mentioned that I would update this for multiple companies over successive weeks. Obviously, this has not happened. The new year has proven to be far more a time consumer than I had anticipated! Thus, for better or for worse, I have chosen to conclude this exercise here. I feel there are many, many other topics that are worth perusing through, too. Lets not forget the rest of the trees in this forest!

RSS Feed

RSS Feed