Look at the ten highest-performing stocks for the last twelve months. Discuss with a friend whether any of them show signs of being stuck in the innovator's paradox.

The above is one of the first exercises in the 28 day innovation regimen presented by Scott D. Anthony in his ever-readable book, The Little Black Book of Innovation. I will quote him to give his description of what this paradox actually is:

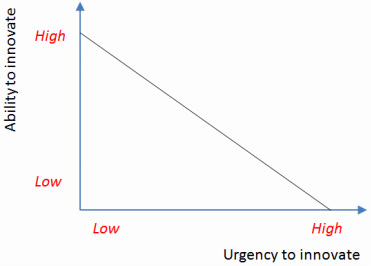

"Here's the problem - by the time it was clear to everyone that [distressed companies] had to change, change was much more difficult. I call this the innovator's paradox. When times are good, you have the ability to do things differently, but not urgency or desire. When times are bad, you urgently need to do things differently, but it's punishingly hard."

"Here's the problem - by the time it was clear to everyone that [distressed companies] had to change, change was much more difficult. I call this the innovator's paradox. When times are good, you have the ability to do things differently, but not urgency or desire. When times are bad, you urgently need to do things differently, but it's punishingly hard."

Anthony goes on to explain that this is the case because companies are so used to operating in their core traditional business model that they feel these tried-and-true methodologies will help reinvent themselves through innovation. Their core strategies effectively become the proverbial hammer to which everything starts to look like a nail. And innovation is no ordinary nail. In fact, it's likely not a nail at all - innovation takes place in largely uncharted territories, facing many unknowns that may share little to no resemblance to the core business.

And therein lies the paradox: as the urgency to innovate increases (usually brought on by the increased pressure from competition and investors), the business shovels more resources at its core operations because this is its comfort zone. In needing to grow, the business invests more into its old way of doing things (i.e. the core business), reducing the resources available for true innovations in the new and uncertain environment, and thus, paradoxically hampering its growth opportunities!

In 2001, Jim Collins' widely popular Good to Great chronicled the rise of 11 companies to Wall Street darling status. But if the last decade has taught us anything, it's that the business has been highly turbulent, with many traditional industries and business models of yore becoming disrupted to their core (e.g. the disruptions to the book publishing industry makes a fascinating read). Most of those companies moved from good to great to ... meh. With some gloriously tanking, such as Circuit City and Fannie Mae.

It is more important than ever for businesses to be on their toes in these rapidly changing and unpredictable waters. They cannot afford to be caught in an innovator's paradox, wasting precious limited resources on outdated competencies, operations, business strategies and methodologies all of which are non-applicable to innovations. The true innovator needs to break out of this paradox by recognizing that innovation happens in an uncertain climate that commands radically different processes. I will devote a future write-up to what these radically different processes may look like.

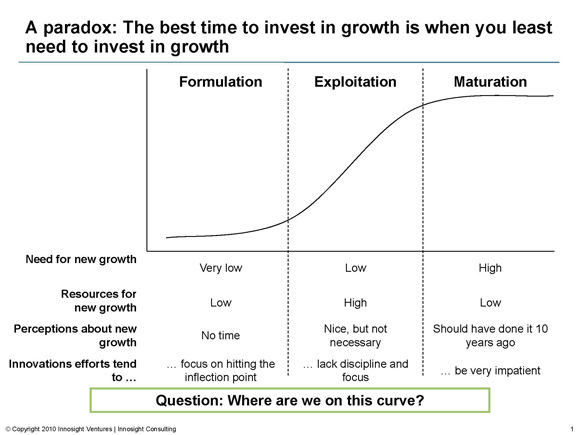

Back to Anthony's challenge. In order to try to hone my innovation skills I have decided to chronicle my attempt to identify whether some of 2012's top North American stocks are caught in an innovator's paradox or not. In the interest of time and space, instead of picking 10 stocks, I will pick 5 stocks that are traded on the TSX and/or Dow Jones which have enjoyed the largest year-to-date stock price increases. My sources will be Fortune's write-up of the top stocks of 2012 and The Globe and Mail's similar contribution. I will use this graph put together by innovation consulting firm, Innosight, to assist me in identifying which stage the companies are at:

And therein lies the paradox: as the urgency to innovate increases (usually brought on by the increased pressure from competition and investors), the business shovels more resources at its core operations because this is its comfort zone. In needing to grow, the business invests more into its old way of doing things (i.e. the core business), reducing the resources available for true innovations in the new and uncertain environment, and thus, paradoxically hampering its growth opportunities!

In 2001, Jim Collins' widely popular Good to Great chronicled the rise of 11 companies to Wall Street darling status. But if the last decade has taught us anything, it's that the business has been highly turbulent, with many traditional industries and business models of yore becoming disrupted to their core (e.g. the disruptions to the book publishing industry makes a fascinating read). Most of those companies moved from good to great to ... meh. With some gloriously tanking, such as Circuit City and Fannie Mae.

It is more important than ever for businesses to be on their toes in these rapidly changing and unpredictable waters. They cannot afford to be caught in an innovator's paradox, wasting precious limited resources on outdated competencies, operations, business strategies and methodologies all of which are non-applicable to innovations. The true innovator needs to break out of this paradox by recognizing that innovation happens in an uncertain climate that commands radically different processes. I will devote a future write-up to what these radically different processes may look like.

Back to Anthony's challenge. In order to try to hone my innovation skills I have decided to chronicle my attempt to identify whether some of 2012's top North American stocks are caught in an innovator's paradox or not. In the interest of time and space, instead of picking 10 stocks, I will pick 5 stocks that are traded on the TSX and/or Dow Jones which have enjoyed the largest year-to-date stock price increases. My sources will be Fortune's write-up of the top stocks of 2012 and The Globe and Mail's similar contribution. I will use this graph put together by innovation consulting firm, Innosight, to assist me in identifying which stage the companies are at:

Will these companies go from great to bust? Or are they innovating at an opportune time that sets them up for further success? Stay tuned for next's week's write up! I encourage you to chime in as well.

Happy New Year!

Happy New Year!

RSS Feed

RSS Feed